The insured retirement advantage®

how it works

Using leverage to significantly increase buying power and enhance the potential benefits of life insurance the Northstar Funding Partners (NSFP) Insured Retirement Advantage® (I.R.A.®) is a unique approach to obtain life insurance for business protection needs, supplemental income and traditional estate and retirement planning. It carefully applies leverage, innovative product solutions and a custom design to enhance a variety of planning strategies.

Designed with a focus on the small business owner and emerging affluent professional the NSFP I.R.A.® provides you the opportunity to introduce the concept of financed life insurance to a significantly wider range of prospects – clients that are not typically eligible for conventional financing arrangements.

The Details

The insured must have a minimum annual (tax return proven) income of $150,000 and be less than 60 years old. Interest payments on the loans begin immediately and the loan is amortizing starting in year 2.

The I.R.A.® program offers qualifying business borrowers access to a full-recourse commercial loan, the proceeds of which are used to fund both annual & single premium loan structures for a life insurance product offered by an approved carrier.* The acceptable face amounts for participating policies range from $500,000 to $4,000,000 (specific preset face amounts are preferred – see detailed program specifications below).

The Insured Retirement Advantage® is a Premium Financed Life Insurance Program. *Please check with Northstar as to life insurance company and product availability.

Specifics & Features

Minimum face amount of $500,000 and maximum face amount of $4,000,000 (subject to carrier retention and reinsurance limits) Prefer to offer specific face amounts of $1m, $1.5m, $2m, $2.5m, $3m, $3.5m, $4m

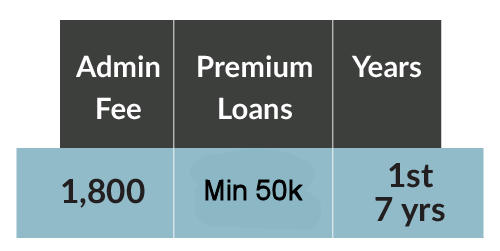

Minimum annual funded premium of $50,000 – based on a ten pay, Non-MEC premium solve

Maximum issue age of 60

Minimum Insured income requirement of $150,000 supported by the last two years of tax returns* (*may be higher base upon carrier requirements)

Loans can be made to Corporations, Trusts and other Entities

Minimum Business Revenue required of $750,000 2 consecutive years (some carrier exceptions may apply)

Business contributions & participation are required in the form of interest payments beginning immediately.

The Insured’s financial position must indicate a liquidity requirement of 125% of the cumulative premium payments in the first 5 years minus the contribution made by the borrower/guarantor in the first 5 years.

Interest rate spread of 1.85% over One Year CMT – for a ten year term.

Interest rate spread is locked for up to 20 years – based on certain requirements

NO waiting for tranches to be created and aggregating unrelated cases – which significantly decreases processing times and accelerates policy funding

No Arrangement / Origination Fee

One Time Financial Underwriting

No Annual Loan Re-qualification

Full Recourse Loan

Low case split commission of 20%

Bespoke solution for a larger client base

Is the New I.R.A® right for you or your clients?

Participating businesses are given the opportunity to use their business to fully fund a life insurance policy with at least $1 million in face value today – all while leaving more business assets free to work for them now!

Click below to contact the NSFP offices today!

New I.R.A.® participants can quickly make contingencies for:

- Estate Planning

- Key Person Policy Funding

- Buy / Sell Agreement Funding

- Executive Bonus Arrangements

- Non-qualified Deferred Compensation

The New I.R.A.® changes everything

Imagine an entirely new world of planning options for your clients and prospects today.