A History of successs

You're the Customer

Northstar Funding Partners has decades of success with thousands of successful transaction with our advisor partners. We are your secret back office to ensure your success in all transaction sizes.

Zero Split Platform

Northstar Funding Partners (NSFP), a leader in life insurance premium finance for over twenty -five years offers the ZS Platform – an industry benchmark with NO COMPENSATION SPLIT! Carrier limitations- restrictions apply

Point of sale Specialists

Professionals Ready to help educate you through the sales process

Transaction Assistance from Start to Finish

New business staff members will help you with daily & weekly updates.

Annual Review

Annual policy and/or collateral review

multi carrier Platform

Northstar uses all available premium finance approved carriers. IUL & WL

Exclusive funding partners

Northstar uses proprietary lenders that offer low and consistent floating & fixed rates.

premium finance leader

history of success

Northstar Funding Partners (NSFP) has provided finance life insurance solutions for two decades and has funded over 3,500 transactions for financial services professionals nationwide! Our approach is based on comprehensive sales support, a broad range of lender partners and cutting-edge technology – all engineered to make our clientele more efficient and effective. When using NSFP you can have complete confidence that you have delivered the most competitive and carefully designed premium finance loan available.

count on us

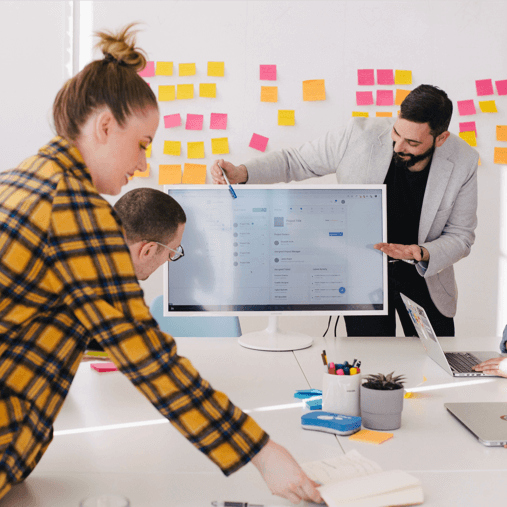

Unrivaled, Value Added Support

An extreme focus area for NSFP is ensuring our clientele has access to sales and support services that exceed expectations and set industry benchmarks. The nexus of our offering is comprehensive case design and loan modeling enabled through years of hands-on experience and technology no other provider can match.

making your success

where we specialize

Supplemental income can help employees and/or clients cover unexpected expenses, save for retirement, or pay down debt. Corporate benefits can also provide employees with valuable resources, such as health insurance, paid time off, and retirement planning assistance. These benefits can help employees improve their overall well-being and financial security.

**Corporate lending can be done through an existing corporation or a newly formed entity, depending on the specific needs of the borrower.**

This statement is accurate because there are pros and cons to both approaches. Using an existing corporation can be more efficient and streamlined, but it may also limit the amount of lending that can be done. Creating a new entity can allow for more lending, but it can also be more complex and time-consuming. The best approach will vary depending on the specific circumstances of the borrower.

Here are some additional details about corporate lending via an existing corporation or newly formed entity:

* **Using an existing corporation:** This approach is often the most efficient and streamlined, as the borrower can simply apply for a loan through the existing entity. However, the amount of lending that can be done may be limited by the corporation’s creditworthiness.

* **Creating a new entity:** This approach allows for more lending, as the new entity will have a clean credit history. However, it can also be more complex and time-consuming to create a new entity, and the borrower may be required to provide more documentation.

The best approach to corporate lending will vary depending on the specific circumstances of the borrower. If the borrower is looking for a quick and efficient loan, using an existing corporation may be the best option. However, if the borrower needs a larger loan or is concerned about their creditworthiness, creating a new entity may be a better option.

**A broad range of net worth and income qualifications means that a lender is willing to consider borrowers with a wide variety of financial circumstances.**

This statement is accurate because lenders with broad range of net worth and income qualifications are more likely to approve loans for borrowers who may not qualify with other lenders. This can be helpful for borrowers who are self-employed, have a fluctuating income, or have a low credit score.

Here are some additional details about broad range of net worth and income qualifications:

* **Lenders with broad range of net worth and income qualifications are often more willing to consider borrowers with a lower credit score.** This is because they understand that borrowers with a low credit score may have other factors that make them good credit risks, such as a high net worth or a steady income.

* **Lenders with broad range of net worth and income qualifications are also more likely to consider borrowers who are self-employed or have a fluctuating income.** This is because they understand that these borrowers may have a good credit history and the ability to repay a loan, even if their income is not consistent.

If you are looking for a loan and have a lower credit score or a fluctuating income, you may want to consider a lender with broad range of net worth and income qualifications. These lenders are more likely to approve your loan and help you achieve your financial goals.

Northstar Funding Partners offers group quotes to businesses and organizations that need to finance life insurance policies for their employees.

Northstar Funding Partners specializes in providing life insurance financing solutions for businesses and organizations. They offer a variety of financing options, including group quotes, that can help businesses and organizations save money on the cost of life insurance.

Here are some additional details about Northstar Funding Partners’ group quotes:

- Group quotes are available to businesses and organizations with at least 2 employees.

- To qualify for a group quote, businesses and organizations must have a good credit rating.

- The interest rate on a group quote is typically lower than the interest rate on an individual loan.

- The terms of a group quote are typically longer than the terms of an individual loan.

If you are a business or organization that needs to finance life insurance policies for your employees, you may want to consider strongly working with Northstar Funding Partners. We can help you save money on the cost of life insurance and get the financing you need to protect your employees’ financial future.

**Northstar Funding Partners can offer competitive interest rates because we have a strong relationship with a network of lenders.**

Northstar Funding Partners has a long history of working with lenders and has established a strong reputation for providing quality service. This allows them to negotiate better interest rates for their clients.

Here are some additional details about the competitive interest rates that Northstar Funding Partners receives from their lenders:

* **Northstar Funding Partners’ lenders are typically large financial institutions with deep pockets.** This gives them the ability to offer lower interest rates to their clients.

* **Northstar Funding Partners has a strong track record of closing loans.** This gives their lenders confidence that they will be able to recoup their investment.

* **Northstar Funding Partners offers a variety of financing options.** This allows them to find the best interest rate for each client’s individual needs.

If you are looking for a competitive interest rate on a life insurance loan, you may want to consider working with Northstar Funding Partners. They have a strong relationship with a network of lenders and can help you find the best interest rate for your needs.